The growth you want—without all the work.

Demonstrate your value with CountingWorks PRO. Our AI-powered marketing automation platform empowers you to reshape the client experience from end to end.

All-In-One Practice Marketing Platform

The easiest way to build, grow, and run your firm.

How it works

One platform that does it all.

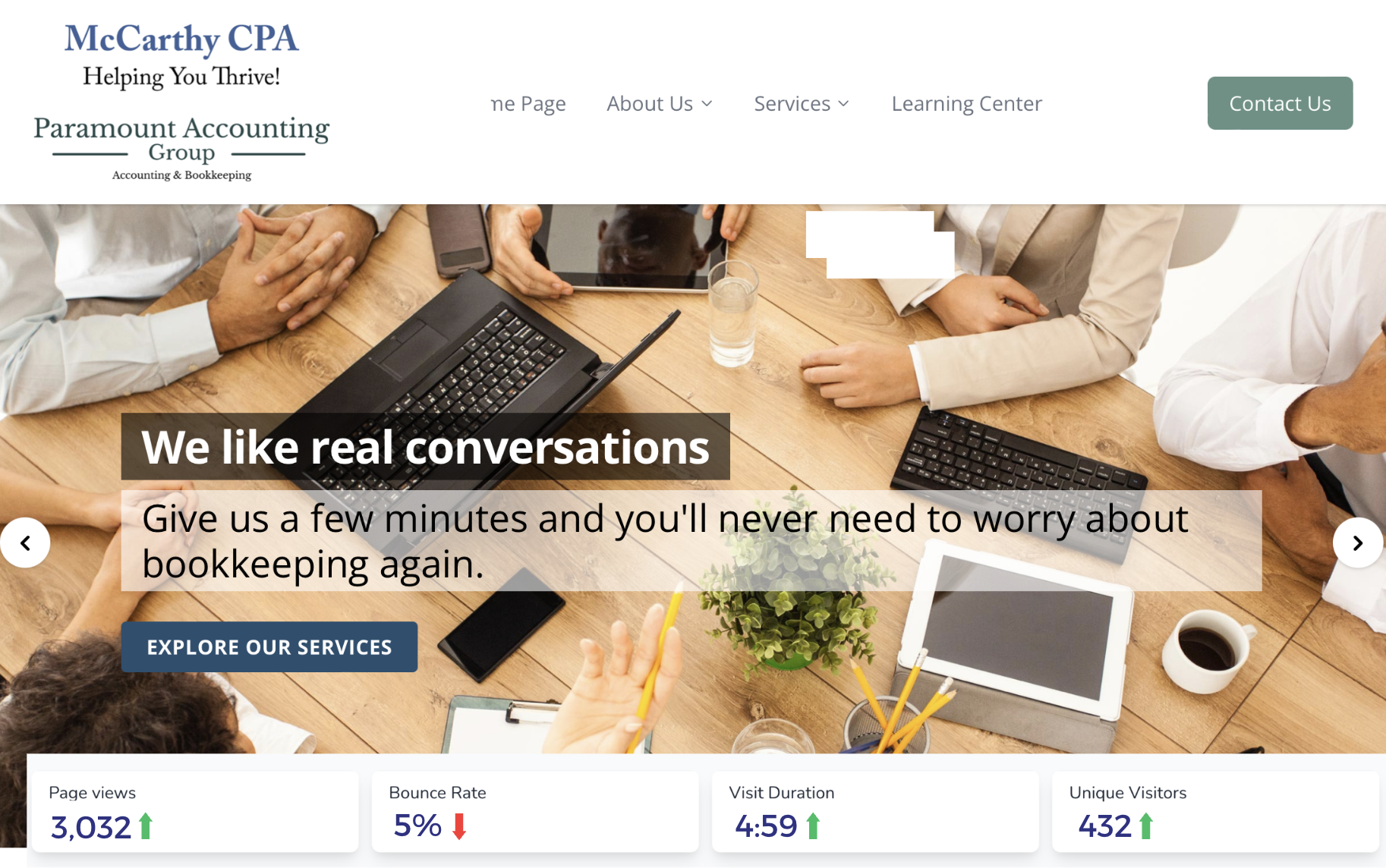

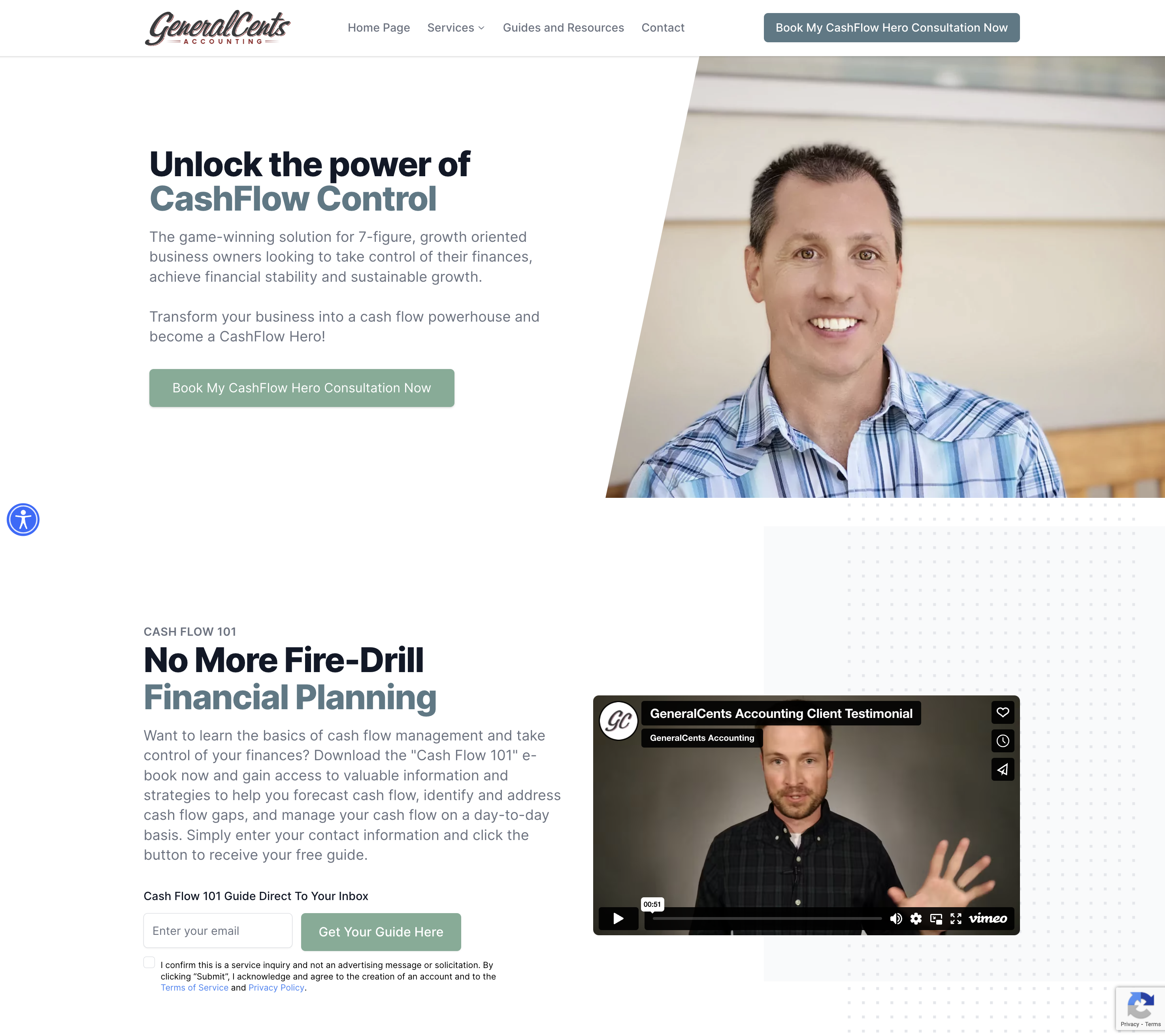

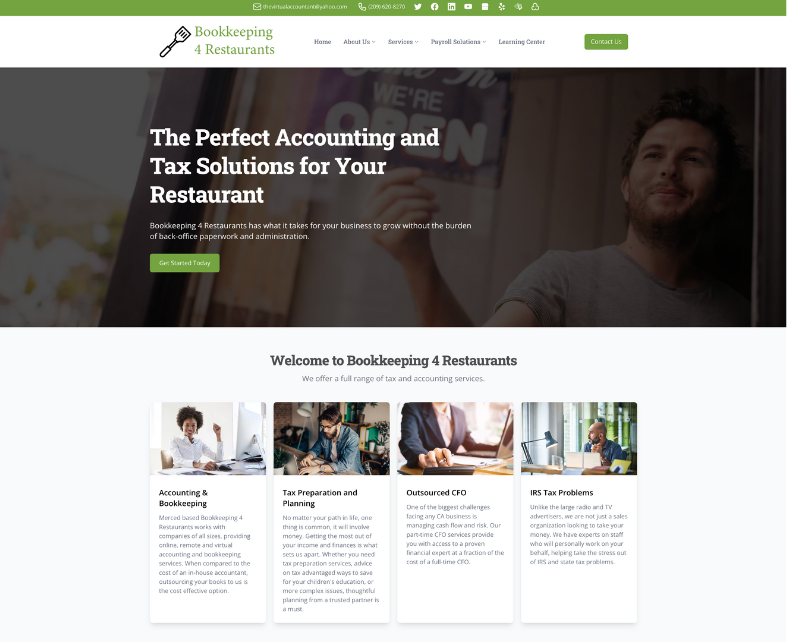

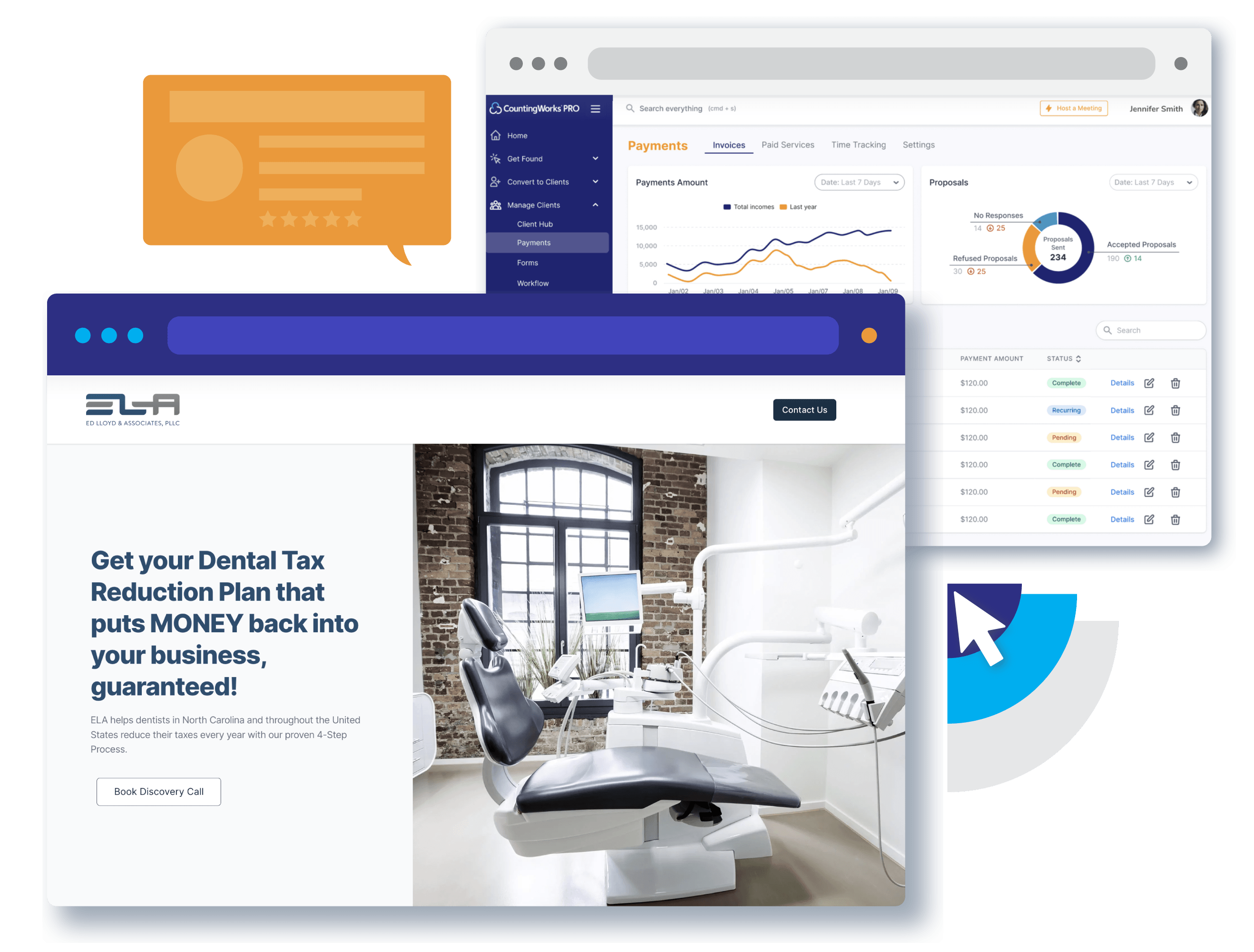

Get found online

Showcase your firm with a search engine optimized website, built just for you. Feed algorithms with engaging blog and social media content. Work with a marketing concierge to perfect your SEO, and outrank your competitors.

Track your website metrics in your dashboard.

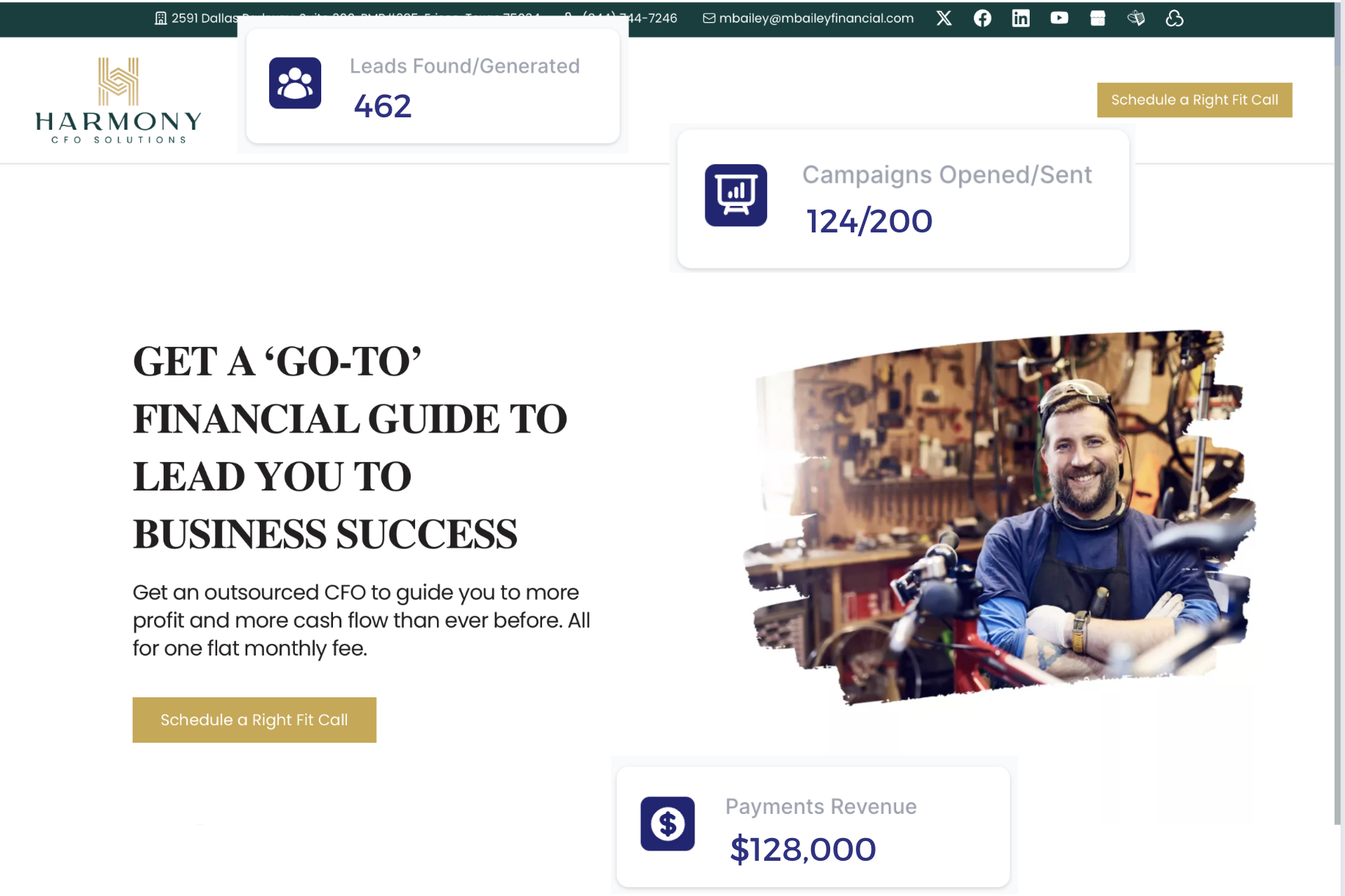

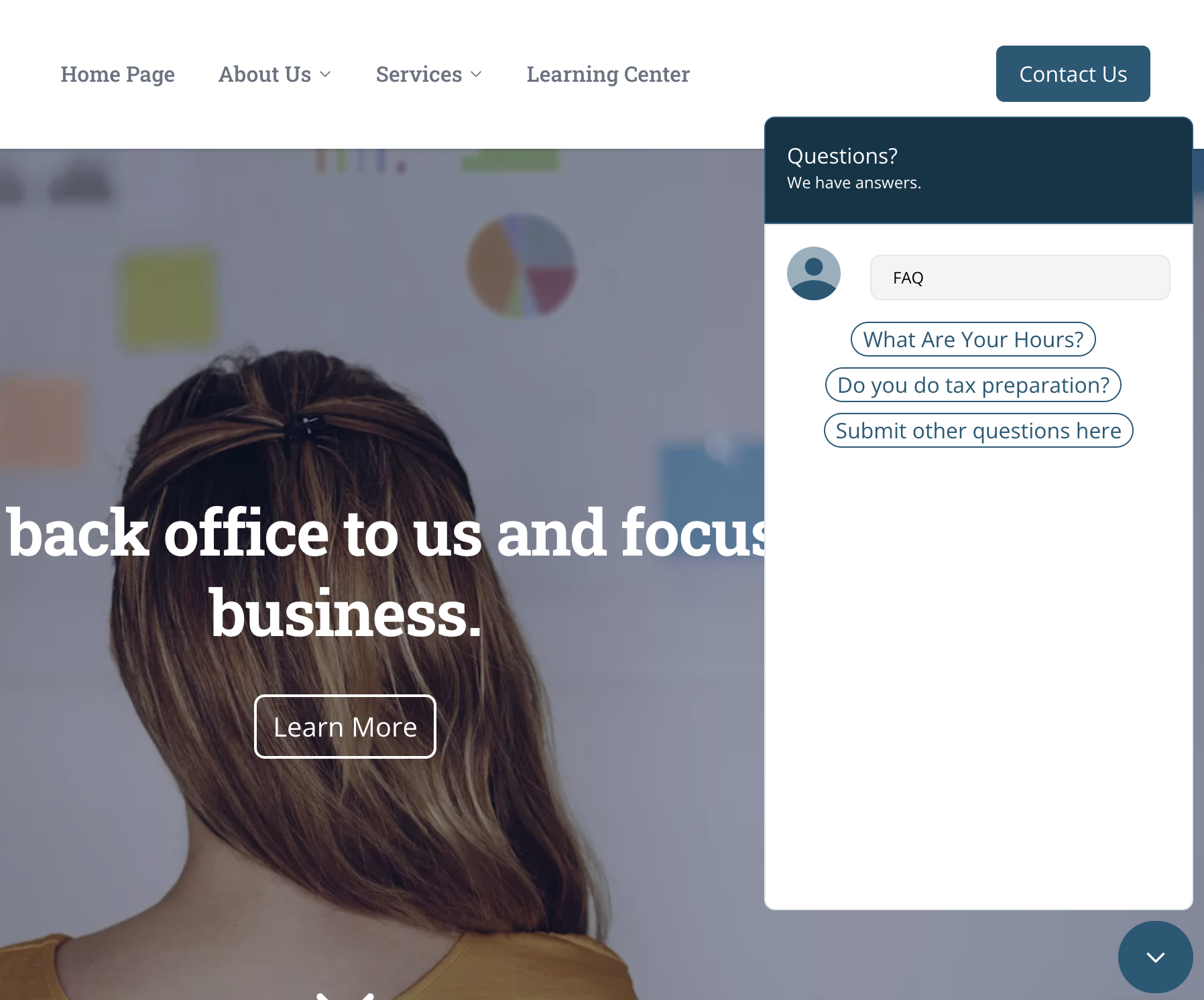

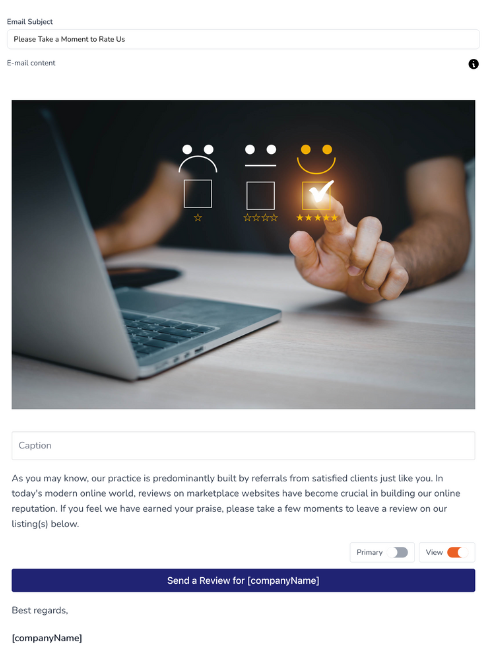

Convert and upsell prospects

Utilize our lead generation options, from landing pages and white papers to customizable lead forms and lead nurture campaigns, to convert prospects into clients. Double your revenue from existing clients with our 5-step upsell campaigns.

Lear more about client marketing

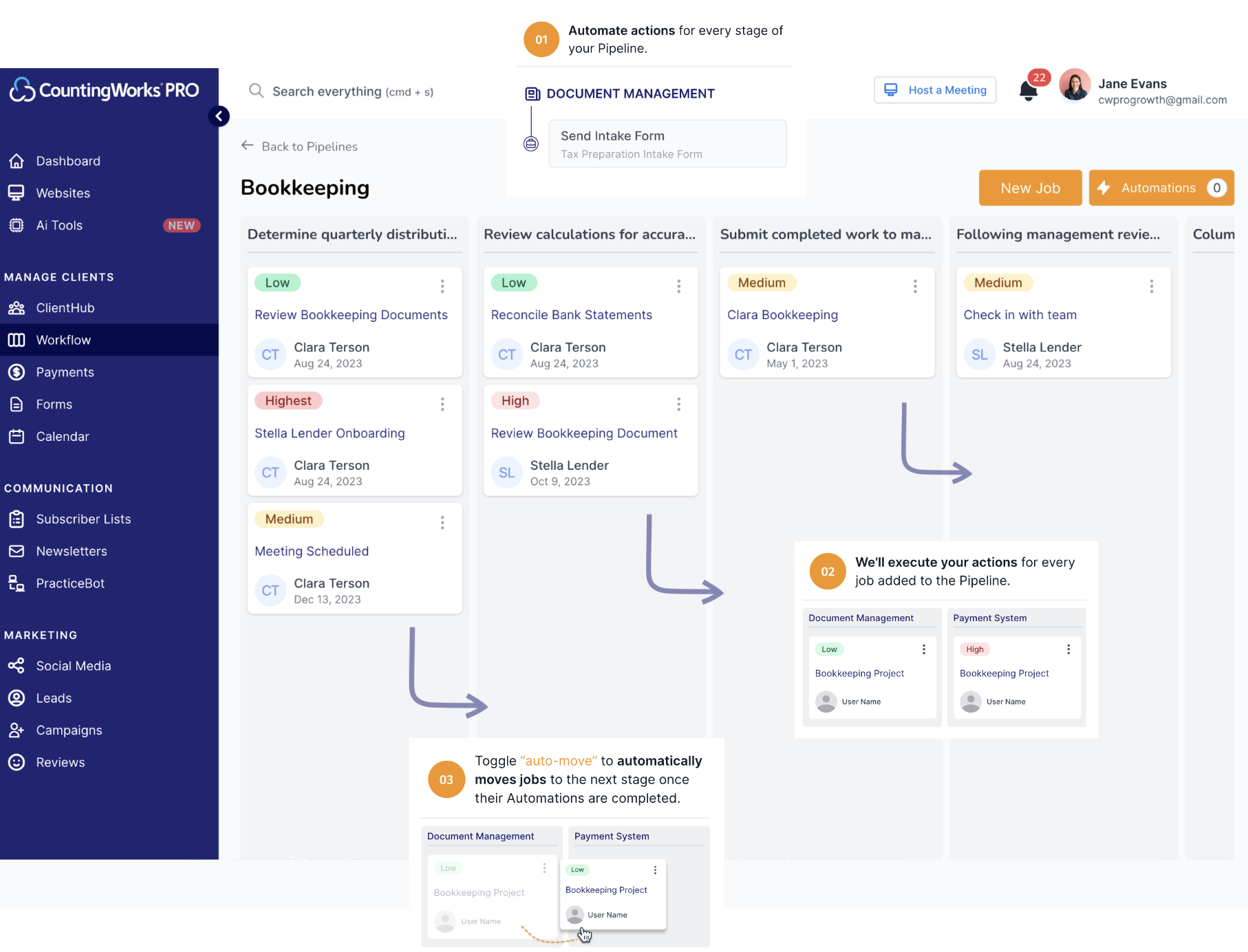

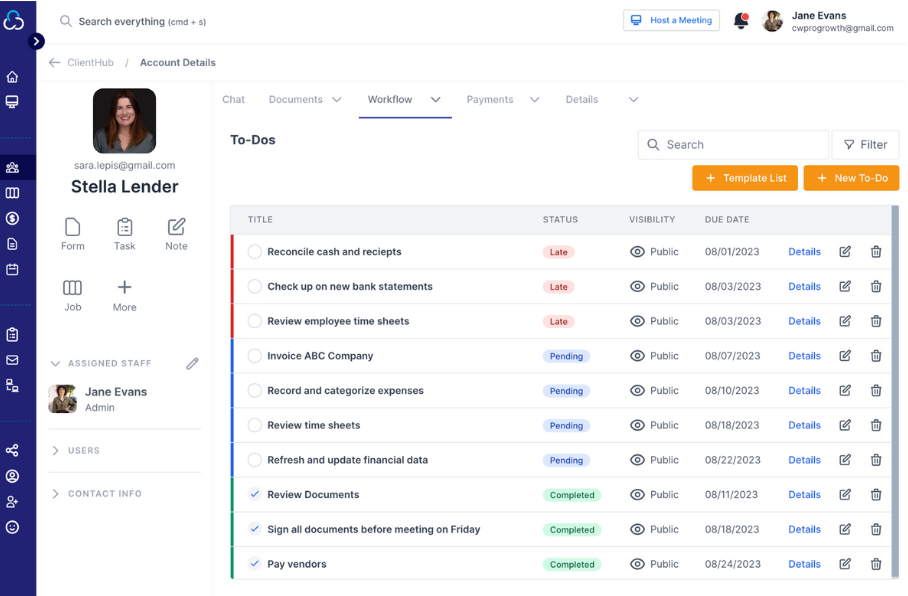

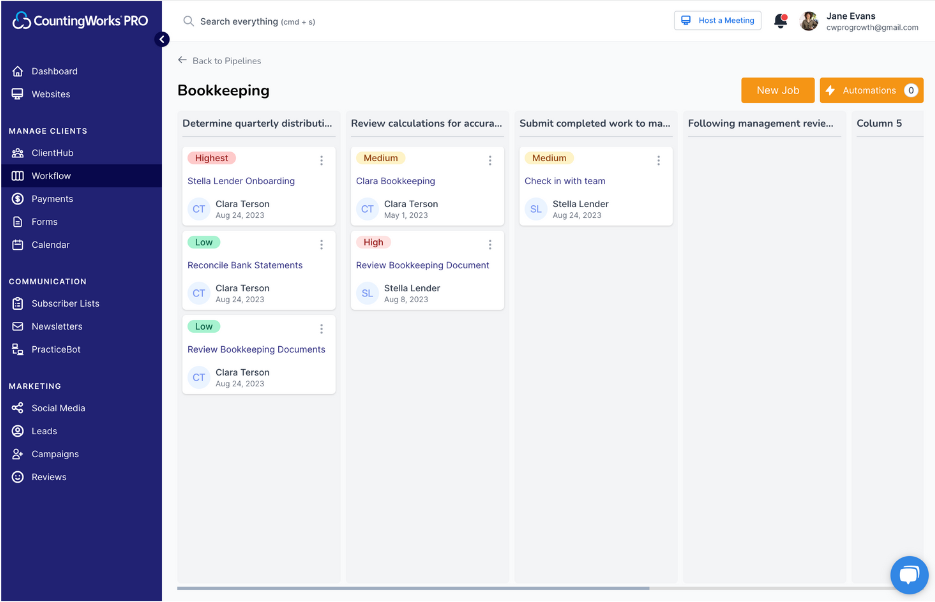

Save time on client work

Connect with your clients in a secure environment, with an intuitive user interface. ClientHub allows you to replace up to 10 other vendors including Calendly, TaxDome, Zoom, Docusign, Asana, and more.

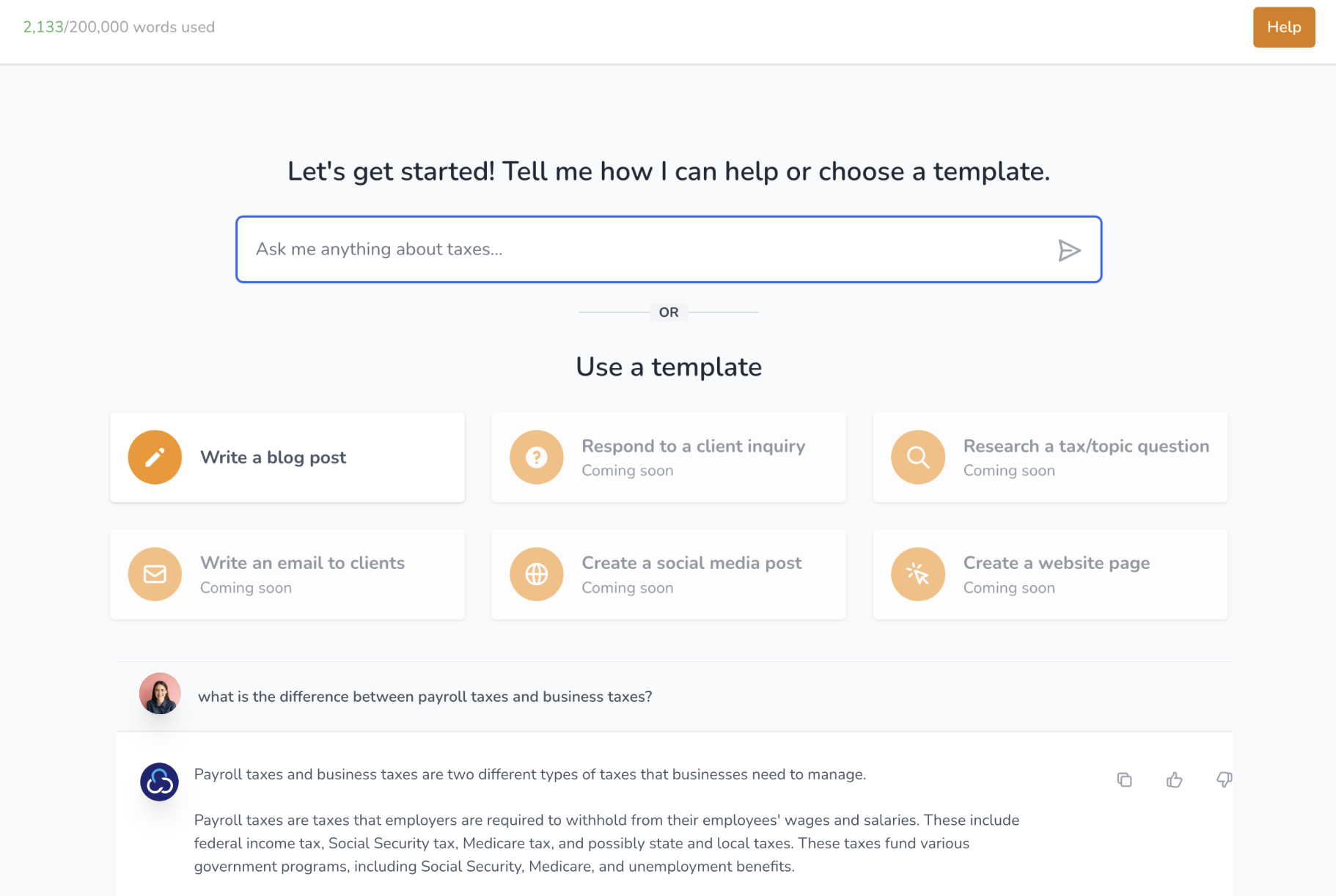

Learn more about our ClientHub CRMWork smarter with AI

Use our powerful AI tools to streamline day to day tasks. Write blogs, create engagement letters, respond to client inquiries, or research tax topics in seconds.

Learn more about AI tools

Impacts seen by our clients

We are trusted by over 8,000 CPAs, Enrolled Agents, and Tax Professionals

10+

200 hours

$17,905

120%

200+

What you get

We know there are other vendors out there.

See how we compare to our competition.

Advice in Your Inbox

Professional advice, ideas, and information to help your practice get going and grow.

Build, grow, and run your firm with CountingWorks PRO

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.svg)